The Fort Jennings State Bank (FJSB, Bank) is committed to meeting the financial needs of the communities we serve, including all low and moderate income and minority areas within our footprint.

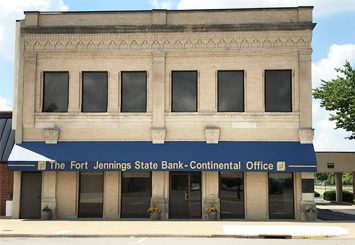

We are pleased to provide the following information for public inspection under the Community Reinvestment Act (CRA). By providing this information online, FJSB is able to provide convenient access to its current file. The Bank's CRA Public File is available at its Main Office, located at 120 N Water Street, Fort Jennings, OH 45844. You can ask to inspect this file, at no charge, any time the Bank is open. If you would like to receive a hard copy of FJSB’s CRA Public File, please visit the Main Office or your local FJSB Office to request a copy. A reasonable fee may be charged to cover printing expenses.

Public Information Available for Inspection

The following information is maintained in the Public File, current as of April 1 of each year, and may be updated periodically.

A) Public Disclosure of CRA Performance Evaluation

A copy of the Bank’s most recent Community Reinvestment Act Performance Evaluation performed by the Federal Deposit Insurance Corporation (FDIC).

FDIC Community Reinvestment Act Performance Evaluation

View/Download PDF

B) Loan-to-Deposit Ratio

The Bank’s quarterly Loan-to-Deposit ratio from December 31, 1997 through the most recent calendar quarter.

Quarterly Loan to Deposit Ratio

View/Download PDF

C) Bank Offices

A current listing of Bank Offices and a listing of Bank Offices opened or closed since January 1, 2000.

1. List of Bank Offices

View/Download PDF

2. List of Branch Offices Opened or Closed since 1/1/2000

View/Download PDF

D) Bank Products

A listing of banking products and services available, along with a copy of the ‘Understanding Your Deposit Account’ brochure.

1. Listing of Services

View/Download PDF

2. Understanding Your Deposit Account

View/Download PDF

F) Public Responses

Public comments related to FJSB’s performance in helping meet community credit needs and the Bank’s written responses to those.

1. Responses to Written, Public Comments

View/Download PDF